The result will not only provide you with your monthly repayment during the interest only period but also what your loan repayment would look like when it reverts to principal and interest. These can be annual fees, service fees (monthly), or account-keeping fees. Loan fee is a fee that you will have to pay throughout the life of your loan. The interest only period typically range from 1 to 5 years. This refers to how long your interest only period is before it reverts to principal and interest. Refers to how often you will be making your repayments and is typically either monthly, fortnightly or weekly. This is referring to the amount of time you have to repay the loan with usual loan term ranging from 25 to 30 years. The interest rate which can be either fixed or variable is the interest rate at which you repay the loan. The loan amount refers to the amount of money you have borrowed or the outstanding loan balance. Here are the information you need to input into the calculator: Call us to discuss your options today, or fill out the form and we’ll get back to you in 24 hours. Our mortgage specialists match borrowers with great home loans by comparing loan products from the top banks and lenders in Australia. If you fit the criteria or are in a unique circumstance where an interest-only loan may be the right fit, Rateseeker can help. While interest-only mortgages aren’t for everyone, lenders may be willing to write interest-only loans to borrowers with a great credit score, low debt-to-income ratio and can provide a large down payment. Our calculators such as the mortgage repayment calculator interest only are a good starting point for anyone trying to find a home loan appropriate to their needs.Īfter the Australian Prudential Regulation Authority (APRA) enforced restrictions on interest-only home loan lending in 2017, interest-only loans became less popular but are still offered by lenders but with more caution. Whether it’s your first home or your third investment home, our calculators help you determine how much you can borrow, pay and save as well as compare loan products to see which one better fits your financial capacity. Our calculator borrowers make informed decisions about their home financing. Compare loans with our interest-only mortgage payment calculator Get expert advice by getting in touch with Rateseeker today. Our mortgage specialists can help you better understand the pros and cons of an interest-only loan.

#INTEREST ONLY MORTGAGE CALCULATOR PLUS#

Rateseeker’s calculator works out the loan repayment amount due after it reverts to principal plus interest payments.

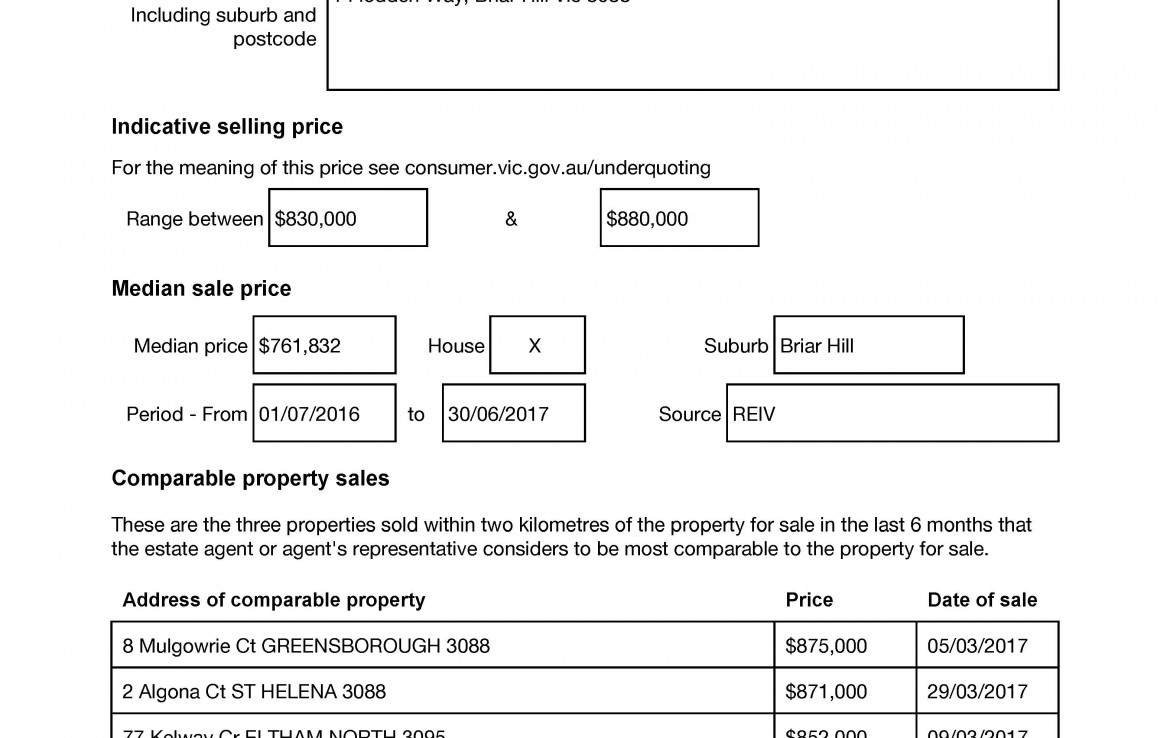

For unprepared borrowers, this may mean future monthly payments that may be harder to afford. The downsides associated with interest-only loans are larger payments at the end of your interest-only period since you are paying off the principal in a shorter time. To get a clearer picture of how much you’ll pay at the beginning of your loan, enter loan details such as loan amount, interest rate, loan term, repayment frequency, length of the interest-only period, and any loan fees in the Interest-Only Mortgage Calculator. Aside from lower initial monthly payments, an interest-only loan still gives you the flexibility to make principal payments on your schedule. An interest-only loan is an attractive mortgage for borrowers who are looking to purchase a more expensive property or want to make smaller payments at the beginning of their loan. This interest-only calculator helps determine if an interest-only home loan is a good fit for you. See how interest-only loans are calculated with our interest-only mortgage calculator

0 kommentar(er)

0 kommentar(er)